Month: February 2024

Adapt or Die: How to develop a Digital Transformation Strategy

Adapt or Die: How to develop a Digital Transformation Strategy

“At least 40% of all businesses will die in the next 10 years... if they don't figure out how to change their entire company to accommodate new technologies.”

- John Chambers - former CEO of Cisko Systems

From increasing costs to legal compliances and logistical challenges, there are a multitude of pressures on a modern business. This is why companies looking to thrive find themselves increasingly turning to technological solutions to free up staff time, streamline their operations and enhance customer experiences. These digital transformations aren’t as simple as they seem on the surface, however, and smart business leaders will need to develop a digital transformation strategy that takes advantage of all that technology has to offer.

HERE ARE OUR TOP TIPS

Around the boardroom tables of the world, one thing is on every agenda – digital transformation. From global conglomerates to SMEs, leadership is keenly aware that in a digital world, those who do not adapt will quickly become irrelevant. In fact, a recent study revealed that 55% of businesses believe they have less than a year to digitalise before they start to suffer financially and lose market share. Businesses must adapt to stay ahead of the game.

By integrating advanced technologies across all aspects of the enterprise, businesses are able to significantly improve a business’s efficiency by automating manual processes, reducing errors and improving productivity. This allows them to not only keep up with the competition, but also to enjoy greater efficiency, productivity and customer satisfaction. This process of implementing these modernising technology advancements is referred to as a digital transformation.

However, the process of digital transformation is not one a company should enter into lightly as it’s not simply about implementing the latest technology and tools. The goal of digital transformation isn’t just to eliminate manual processes, but to augment your operations, streamlining workflows and improving the customer experience. This must all be considered within the context of your budgets, timelines and overall business goals, while managing organisational risks. As a result, it’s imperative to develop a digital transformation strategy which takes into account all of these aspects and potential pitfalls of an overhaul of this nature.

A digital transformation is a necessary change, but it can’t work without buy in and leadership from the top down. This is something the company needs to do together, and some tough choices are coming. With a likely high price tag and disruptions on the cards, the company is about to go through a challenging time; making sure everyone at the top understands this is a powerful first step.

Before embarking on your digital transformation, you will need to know exactly what needs to change.

To do this you will need to do a complete, top to bottom analysis of your current technology and systems in order to:

- Review business processes and highlight inefficiencies

- Identify technology gaps or areas where your existing systems fall short

- Define functional capabilities needed to effectively support or improve your processes.

Digital transformations are not as much about technology as they are about change. A thorough digital transformation will likely change the way everything is done in your company and will therefore require a culture of agility, communication and open mindedness.

Leaders will need to take ownership of the transformation and prepare all involved well ahead of any actual proposed developments. Employees, clients and other stakeholders will all need to understand the transformation strategy and how it will affect them. Training sessions will need to be organised and feedback sessions should be incorporated into the strategy at each step to see if the changes are working as proposed. This is an exciting time that will hopefully end up with your employees working on fewer mundane tasks and clients getting better service. Make sure they know that this is what the effort is about.

With so much exciting new technology around it’s easy to get carried away with what you decide to implement. It is important that whatever projects go ahead are done to the benefit of the business and that they do not put pressure on cash flow and savings for other projects. Speaking to your accountant should help you determine which areas are most critical for advancement, and which will have the biggest impact on company operations. They will also be able to assist you in developing a roll out plan, so you can be sure to get all you need within a reasonable timeframe.

It’s one thing to read about these new technologies online and quite another to truly understand how they might impact your workplace. Proper research and expertise need to be included when deciding which elements of cloud computing, edge computing, AI, Data Analytics and Digital Experience will make a difference for your business. Would better reporting help you to make decisions? Do you have a large remote force that needs better organisation? Do you have a factory floor that could do with less wastage? Your business’s needs will determine where you have to invest.

Your digital transformation is not the time you want to cut corners with your technology partners. When choosing which solutions to use, don’t be afraid to ask the hard questions around whether the technology is scalable and easily adaptable for future needs. Does your partner share the same vision as your organisation? Do they understand your industry? Do they provide support for upgrades and downtimes, and what does that support look like? Will you be down for a day or a month? Does the technology work with your current systems, or will you need to retrain everyone? How future-proof is your partner?

Critically, you need time and budget to educate and train your staff on your new systems. It’s futile implementing new technology if no one can use it. This needs to be built into your timeline. As an added benefit, investing in employee training has been shown to increase employee satisfaction, business efficiency and consistency so don’t be afraid to give your employees the skills they need to operate in a modern workplace.

Build your team stronger this year

Build your team stronger this year

“Great things in business are never done by one person. They're done by a team of people.”

- Steve Jobs

All stakeholders benefit when happy employees enthusiastically work together as a strong cohesive team to achieve clear and common goals. Given the demanding realities of the business world, this may seem like a lofty ideal, but in just five practical steps outlined in this article, you can build a stronger team in 2024, allowing your business to enjoy all the well-documented benefits of great teams – which go beyond just the bottom line – throughout the months ahead.

There are many benefits to having a great team, and these have been backed up by scientific research around the world.

These include for example:

- Improved productivity, with thousands of employees noting that having the respect of their peers is the number one reason they go the extra mile at work.

- Better problem-solving, as team members pool their diverse unique talents and skills to find smart solutions to ever-more complex problems.

- Generation of innovative ideas as team members with different experiences, opinions and perspectives collaborate.

- Taking more calculated risks, as team members know they have the support of a team.

- Personal growth, increased job satisfaction and reduced stress are all benefits of working in a team.

- Reduced risk of burnout as the workload is shared among team members.

FIVE STEPS TO BUILD YOUR TEAM STRONGER

- Ensure fair remuneration and that each team member’s salary is optimally structured.

- Put the basics in place: Employment contracts, salary slips, leave and sick leave, job descriptions and performance reviews.

- Offer incentives for employees to increase their earnings – from simply working extra hours to profit sharing for achieving company goals.

- Team members should have a clear understanding of their roles and responsibilities, and how it contributes to achieving the team’s goals.

- In addition to safe, clean and friendly working conditions, each team member should have the right skills and the right tools to make their contribution to the team’s success effectively and efficiently.

- Be sure to provide practical means to track the team’s progress to maintain motivation.

- Non-monetary perks that have proven to be very popular include flexible working hours, extra time off, transport, childminding facilities, fun social activities and opportunities to volunteer

during work time. - Health and wellness programmes are an affordable and practical option to help team members to better care for their health, improving productivity and reducing both absenteeism and presenteeism (when team members are at work, but are too ill to perform their duties).

- Regular and prioritised communication – from weekly team meetings to reports with regular due dates are crucial to share information and provide feedback to the team and individual members.

- Provide all team members with opportunities to share their input, actively seek out suggestions, listen to understand and work to build consensus, which is likely to result in the best decisions.

- Define common goals and clear steps to achieving these goals.

- Be certain to celebrate milestones and successes with the team, recognising each team member’s efforts.

- Define the lessons learnt from failures and adjust the team’s approach accordingly.

- Consider team-building activities that can foster cooperation and build trust and team spirit.

This year, build your team stronger with these simple steps, and set your company up to enjoy all the well-documented benefits of great teams – from increased productivity

to better problem-solving and innovation – in the year ahead and beyond.

These Invoicing Tips Could Save Your Business

these invoicing tips could save your business

“Never take your eyes off the cash flow because it's the lifeblood of business."

- Sir Richard Branson (Entrepreneur, Investor, Author)

Cash is king, said one anonymous business genius. At the end of the day, it’s having money in the bank that keeps a company running smoothly. According to a recent study by Sibongiseni Selby Myeni at the Walden University, the majority of SA’s small to medium enterprises are destined for the scrap heap and the majority of these cases will be due to a lack of cash flow.

Amid a rising trend of unpaid invoices, how can your invoicing system

ensure your financial stability?

It’s no secret that poor cash flow management can sink businesses. Without ready cash in the bank a business will struggle to meet its own commitments, destroying relationships, increasing costs

through interest, and losing out on critical suppliers. The good news is that some simple changes to company invoicing can result in a far higher percentage of paid invoices, quicker payment and

ultimately better cash flow. Here’s what you need to do.

The best time to send an invoice is when you and your relationship with a client is still fresh in everyone’s minds. Ask for the invoicing details up front, so you can send the invoice with the final deliverable.

The invoice should request payment immediately, or failing that, at the end of the month and not only when you need the money. Smaller businesses are likely to comply, and bigger companies may rush faster to ensure you get paid promptly within their next payment cycle. Making the assumption that your client needs leeway or payment time scales well into the future only guarantees your invoice loses priority.

If you are going into a large contract, it’s wise to do some groundwork on your client. One of the biggest reasons for non-payment is the client’s own cash flow worries. Getting some intelligence from other clients, or if possible, running a background check on them, will ensure you don’t invest huge amounts of time and resources into defaulting clients. If you do establish a client might default, you don’t have to cut them off, simply invoice with the intention of being paid up front, or at least request a deposit and include a punitive “late payers’ fee” or interest on non-payment to encourage them to prioritise you.

Your larger clients are going to be fanatical about their payment cycles. Ask them upfront when they need to receive invoices and make sure you get the invoice in before that date. Failure to do so will often mean a 30 or even 60 day delay in payment.

If you have a client who uses the same service regularly, don’t be afraid to ask for retainers and other contracts, to be paid by debit order, to cover the costs rather than invoicing each month. Be sure to offer perks to encourage your clients to take you up on these offers.

When it comes time to pay, even struggling companies will want to pay the people they know and like first, over the anonymous supplier. Knowing who at your client is responsible for the invoice and following up politely with them is a great way to ensure your invoices are treated with priority.

Provisional Tax. All you need to know.

PROVISIONAL TAX: ARE YOU READY FOR THE CRUCIAL 29 FEBRUARY DEADLINE?

“Provisional tax is merely a mechanism to pay the normal income tax liability during the tax year… an advance payment of a taxpayer’s normal tax liability.”

- SARS

To provisional taxpayers, especially those who are liable for provisional tax in both their personal capacities and as business owners, it may well seem that there are endless provisional tax deadlines and payments to be made every year. There are indeed numerous income tax provisional and final declarations and payments that overlap across tax years, which is certainly confusing, and yet non-compliance is met with some of the harshest penalties imposed by SARS, most notably in respect of the second provisional tax declaration and payment, due by the end of February for individuals, and for companies with a February financial year end.

In this article we find out who are provisional taxpayers, what they need to pay and when and how to avoid the penalties for non-compliance.

ALL YOU NEED TO KNOW ABOUT PROVISIONAL TAX

- Provisional tax is not a type of tax, but a cash flow mechanism to collect pre-payments of taxes that must be made in respect of individual provisional taxpayers’ and company taxpayers’ normal annual income tax prior to a final determination of the annual tax liability.

- At least two amounts are paid in advance during the year of assessment, based on estimated taxable income for the year of assessment. A third optional payment can be made.

- Ensures government collects cash more evenly during the year and not just in bulk amounts following final tax assessments which are annual and usually in similar time periods e.g. end of December or February.

- Spreads the payment of a taxpayer’s year’s income tax liability over two or even three provisional payments.

- Prevents taxpayers facing large income tax liabilities that are only revealed at the end of the year of assessment when the annual personal income tax (PIT) return ITR12 or the annual corporate income tax (CIT) return ITR14 is filed.

- The first, second and third provisional payments are credited against any tax owing after the final income tax return is filed, and any further tax liability will then become due.

- Reduces the risk and amount of interest accruing between the time when a tax liability is determined and when it is paid.

- Provisional tax is paid by individuals who earn income other than, or in addition to, a salary or traditional remuneration paid by an employer from which PAYE deductions are made – including those who earn income from conducting a business, such as members of CCs, sole proprietors and company owners.

- Companies and trusts.

- Any person notified by the Commissioner of SARS.

- Exceptions and thresholds apply in every instance, so be sure to check with your accountant.

Below is an example of the provisional and final income tax due dates for a company with a February financial year (FY) end.

- The 2024 year of assessment (1/03/23 – 29/02/24) and

- The year 2025 year of assessment (1/03/24 – 28/02/25)

It shows how the due dates for different years of assessments overlap to create both seemingly endless provisional tax deadlines and much confusion.

Due Date | Period | Year of Assessment | Requirement |

31 Aug 2023 | 6 months from start of year of assessment | 2024 | First provisional tax payment |

29 Feb 2024 | Last working day of the year of assessment | 2024 | Second provisional tax payment |

31 Aug 2024 | 6 months from start of year of assessment | 2025 | First provisional tax payment |

30 Sep 2024 | Last business day of September; or within six months of end of the previous year of assessment | 2024 | Third and voluntary provisional payment |

28 Feb 2025 | Last working day of the year of assessment | 2025 | Second provisional tax payment |

28 Feb 2025 | 12 months from end of financial year end | 2024 | Annual company income tax (CIT) return IRT14 |

30 Apr 2025 | Usually 60 days | 2024 | Any further payment due on IRT14 – 2024 |

30 Sep 2025 | Last business day of September; or within six months of end of the previous year of assessment | 2025 | Third and voluntary provisional payment |

28 Feb 2026 | 12 months from end of financial year end | 2025 | Annual company income tax (CIT) return IRT14 |

30 Apr 2026 | Usually 60 days | 2025 | Any further payment due on IRT14 – 2025 |

The company provisional tax due dates shown in the table above are the same for individual provisional taxpayers, but individuals who are provisional taxpayers will be due to file their annual personal income tax (PIT) returns in January at the end of the tax season as announced by SARS.

HOW MUCH ARE THE PROVISIONAL TAX PAYMENTS?

Individual Provisional Taxpayers

- During every period, individual provisional taxpayers must submit an estimate of their total taxable income in the year of assessment, excluding any retirement fund lump sum or withdrawal benefit or any severance benefit. The taxpayer’s estimate must be informed by a reasonable calculation.

- The taxable portion of the aggregate capital gain for the current year of assessment must be included.

- The estimate may not be less than the ‘basic amount’ which is the taxpayer’s taxable income assessed for the preceding year of assessment, less any taxable capital gain; the taxable portion of a retirement fund lump sum or withdrawal benefit or severance benefit, and other amounts specified by SARS, unless SARS approves a lesser amount. SARS can still adjust an estimate upwards that is more than the basic amount but less than a reasonably calculated amount.

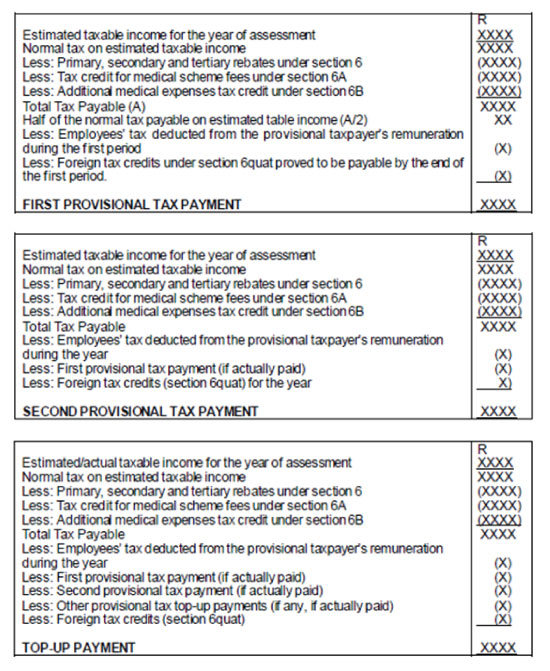

- The calculations provided by SARS below show why professional assistance is optimal.

Source: SARS

Company Provisional Taxpayers

- Company provisional taxpayers must submit a return of an estimate of the total taxable income for the year of assessment.

- It cannot be less than the basic amount, which is the taxpayer’s taxable income assessed for the latest preceding year of assessment, less the amount of any taxable capital gain in that year of assessment.

- The basic amount for all taxpayers must be increased by 8% if the estimate is made more than 18 months after the end of the latest preceding year of assessment.

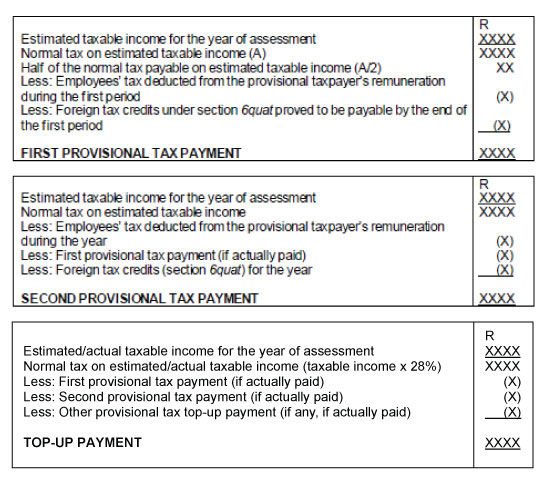

- The calculations provided by SARS below reveal why the assistance of your accountant is invaluable.

Source: SARS

top tips

- SARS can ask for the estimate to be justified and can increase the estimate if they are dissatisfied with the amount, and this is not subject to an objection or appeal.

- SARS provides the following advice: ‘the calculation must be one which has been carefully considered and is thoughtful, earnest and sincere…” and the amount of the estimate must be determined “sensibly and by careful reasoning and judgment, in a mathematical manner, and using experience, common sense and all available information”.

- Keep accurate records of all the calculations and source documents used.

THE HOW TO'S AND PENALTIES

- A provisional return or IRP6 return must be submitted by all provisional taxpayers for the first and second periods.

- Even if you or your company owes no tax, a ‘nil’ return showing taxable income is equal to zero must still be filed on time.

- If an IRP6 is filed more than four months after the deadline, SARS considers a ‘nil’ return to have been submitted – unless the actual taxable income is really zero, this will result in penalties.

- A 10% penalty will be levied on late payments, along with interest at the prescribed rate.

- Harsh penalties for under-estimation are levied when the actual taxable income is more than the taxable income estimated on the second provisional tax return. The penalty amount depends on whether the actual taxable income is more or less than R1 million.

- Where taxable income is more than R1 million – if the taxable income estimate for the second provisional tax payment is less than 80% of actual taxable income declared on the annual tax return, a 20% penalty will be levied on the difference between: the amount of tax payable on 80% of actual taxable income after taking into account rebates, and employees’ tax and provisional tax already paid.

- Where taxable income is less than R1 million – if the taxable income estimate for the second provisional tax payment is less than 90% of actual taxable income, and is also less than the basic amount, a penalty is levied of 20% of the difference between: employees’ tax and provisional tax paid in the year of assessment, and the lesser of (a) the normal tax payable on 90% of actual taxable income (after deductible rebates) or (b) the normal tax payable for the year of assessment on the basic amount.

- Interest at the prescribed rate (7.75% pa subject to change) will also be levied on the underpayment of provisional tax as a result of under estimation.

Provisional taxpayers, whether individuals or companies, should consider relying on the expertise of their accountant to assist them in preparing and/or reviewing their provisional tax and income tax returns prior to submission. Similarly, where penalties and interest have already been imposed and levied, taxpayers may need expert assistance to successfully make a request for the remission of such penalties and interest to SARS.

TAX DEADLINES

- 07 February – Monthly Pay-As-You-Earn (PAYE) submissions and payments

- 23 February – Value-Added Tax (VAT) manual submissions and payments

- 28 February – Excise Duty payments

- 29 February – CIT Provisional Tax payments

- 29 February – PIT Provisional Tax payments

- 29 February – Value-Added Tax (VAT) electronic submissions and payments